California home sales up double-digits monthly for first time since 2011

By CAR.org

LOS ANGELES (July 18) – After a couple months of lackluster growth in transaction volume, California existing home sales rose to their highest level in nearly four years in June, as sales surpassed the 400,000 mark for the fourth consecutive month, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

LOS ANGELES (July 18) – After a couple months of lackluster growth in transaction volume, California existing home sales rose to their highest level in nearly four years in June, as sales surpassed the 400,000 mark for the fourth consecutive month, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

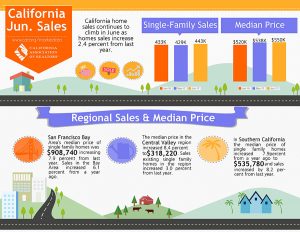

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 450,960 units in June, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide sales figure represents what would be the total number of homes sold during 2016 if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

The June figure was up 10 percent from the revised 409,840 level in May and up 2.2 percent compared with home sales in June 2015 of 441,450 (revised). The month-to-month increase was the first double-digit monthly gain since January 2011 when sales of existing homes rose 11.3 percent from December 2010.

“Market conditions suggest that demand for housing will remain steady through the rest of the summer,” said C.A.R. President Pat “Ziggy” Zicarelli. “However, inventory is still tight, especially at the low end of the market, and this keeps competition for those homes at an extremely high level. The recent march of mortgage rates to ever lower levels will also add to the strong demand for entry-level homes.”

Rising demand combined with tight supply kept upward pressure on prices in June. The median price of an existing, single-family detached California home increased 5.5 percent in June to $519,440 from $492,320 in June 2015. June’s median price was 0.1 percent lower than the revised $519,750 recorded in May 2016. The median sales price is the point at which half of homes sold for more and half sold for less; it is influenced by the types of homes selling as well as a general change in values.

“The annual gain in the median home price is being driven by more sales at the mid-segment housing market, which comprise at least half of the overall demand,” said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. “Price growth appears to be cooling somewhat in San Francisco, where the 3.2 percent increase was less than the statewide gain of 5.5 percent.”

Other key points from C.A.R.’s June 2016 resale housing report include:

- C.A.R.’s Unsold Inventory Index, which indicates the number of months needed to sell the supply of homes on the market at the current sales rate, dipped slightly to 3.2 months in June from 3.4 months in May. The index stood at 3.2 months in June 2015. At the state level, there were 2.6 percent fewer homes available for sale in June compared with a year earlier. The long-run average home supply is 6.1 months, indicating inventory levels are running at roughly 60 percent of normal.

- The median number of days it took to sell a single-family home dipped slightly in June to 27.1 days, compared with 27.3 days in May and 28 days in June 2015.

- According to C.A.R.’s sales-to-list price ratio*, tight inventories also appear to be driving final sales prices closer to listing prices, with sales prices slightly decreasing to 99.6 percent of listing prices statewide in June from 99.7 percent in May.

- The average price per square foot** for an existing, single-family home statewide was $247 in June 2016, down from $248 in May but up from $237 in June 2015.

- San Francisco County had the highest price per square foot in June at $837/sq. ft., followed by San Mateo ($793/sq. ft.), and Marin ($633/sq. ft.). Counties with the lowest price per square foot in June include Siskiyou ($122/sq. ft.), Tulare ($126/sq. ft.), and Kern and Kings ($131/sq. ft.).

- Mortgage rates are expected to remain low in the foreseeable future due to global economic uncertainty. Mortgage rates declined in June, with the 30-year, fixed-mortgage interest rate averaging 3.57 percent, compared with 3.60 percent in May and 3.98 percent in June 2015, according to Freddie Mac. Adjustable-rate mortgage interest rates slipped in June to an average of 2.78 percent, a decline from 2.81 percent in May and 2.99 percent in June 2015.

Read Entire article on www.car.org